“Trusts are a very legitimate form of business structure. They are very widely used in small businesses, in family businesses…” (Prime Minister, Malcolm Turnbull)

So, what is a business structure?1

In Australia, the vast majority of businesses operate either as:

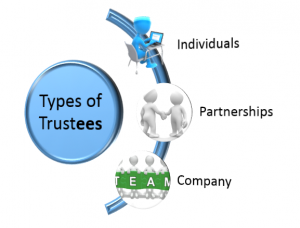

- A Sole-Trader (an Individual Person operating under their own personal name or use a registered business/trading name,

- in Partnership (two or more people and/or companies operating in agreement) or under

- a Proprietary Limited company (Pty Ltd – administered by Director(s)[individuals], it is a private, limited liability company, that can not sell its shares to the public) or

- other business structures which include Limited businesses and Incorporated Associations, among others.

Each of them can operate under their ABN registered name or use a registered trading/business name2.

How do Trusts form a part of it?

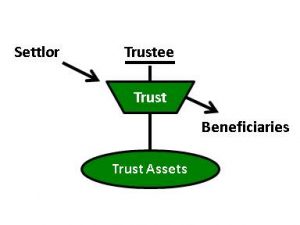

All of these can operate as the Trustee for a Trust. According to the NSW Law Society, the three main types of trusts used in Australian business are the Discretionary (or family) trust, Fixed (or Unit) trust and Hybrid (a combination of the two). The Trustee(s) administer the trust, owing a duty of care to the Beneficiaries, considering their best interests.

Why a Trust?

There are several reasons to form a trust. The two most relevant, when operating a business, is to “protect assets from financial claims made against the Beneficiary” and to “provide greater flexibility in tax planning and other tax benefits” (NSW Law Society).

Who cares?

BDM’s and Relationship Managers recognise that “good service is good business” ~ Siebel Ad. So when it comes to Customer Service, you need to

“get closer than ever to your customers. So close that you tell them what they need well before they realize it themselves.” ~ Steve Jobs

“Your customer doesn’t care how much you know until they know how much you care.” ~ Damon Richards

“The more you engage with customers the clearer things become and the easier it is to determine what you should be doing.” ~ John Russell

… especially when entering into managed service contracts or equipment rentals with them. When Partnering with TPC Finance, we take the time to understand your client’s business structure. This helps streamline the process, ensuring the right person/people sign the agreements, leading to quicker settlements and more satisfaction with our Partners.

If you’re about to engage with a potential customer and have identified their Australian Business Number through ABN Lookup and/or their Registered business/trading name through ASIC Connect, you’re that much closer than ever to identifying whether a Trust is involved. It makes processing even easier and quicker when your customer has a current copy of their Trust Deed handy.

There is no definitive public register of Trusts, identifying Trustees or Beneficiaries, and in many cases, customers themselves don’t recall or understand the nuance between Trustee, Trust and Beneficiary. By becoming a Partner of Choice with TPC Finance, we are happy to contact your customer’s Accountant or Solicitor for the Trust information or sometimes even search Credit Registers for clues.

Call or email us now, to see how TPC Finance can be the Partner of Choice for you and your customers.

1 Further information on business structures can be found at the ATO’s Starting your business video, ASIC’s Choosing a business structure, or from the Australian Government’s Business Structure webpage and AUSTRAC’s Part B of an AML/CTF program.

2 Trading names are being phased out for Registered Business Names, administered through ASIC.